Birthdays & Anniversaries

The BIG List of Birthdays & Anniversaries April 27, 2023 ...Read more

The BIG List of Birthdays & Anniversaries April 27, 2023

The BIG List of Birthdays & Anniversaries April 27, 2023 ...Read more

The BIG List of Birthdays & Anniversaries April 27, 2023

Kalli Christ talks Big Brothers Big Sisters Murder Mystery Dinner Theater! Take a walk down memory lane with Lucy, Ricky, Fred, and Ethel. Join them for some Latin music and dancing at Ricky’s ...Read more

You’ve likely heard ads on the TV or radio about the Camp Lejeune class action lawsuit for U.S. military veterans and their families exposed to tainted water at the camp. Marketing agencies ...Read more

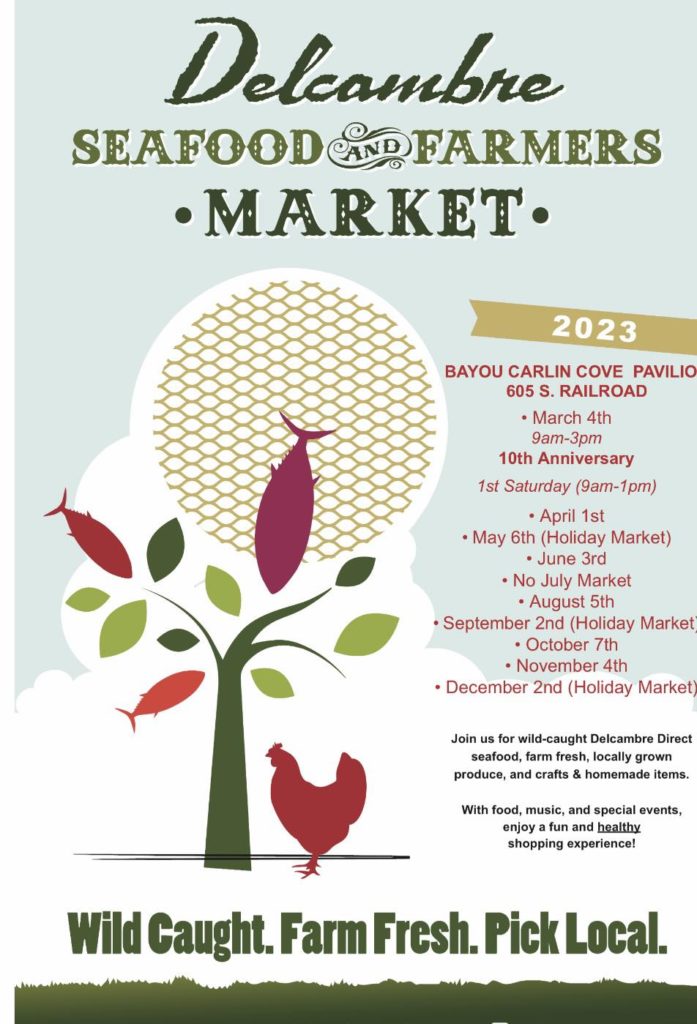

Treat Mom to the special Mother’s Day market Saturday, May 6th from 9-1 p.m. You can purchase your shrimp fresh from the boats! #delcambreseafoodandfarmersmarket ...Read more

Festival International Food Can’t Live Without The BIG List Google Me This 102 Seconds of Good The BIG Wheel of Meat Hospice Raffle ...Read more

Festival International

Food Can't Live Without

The BIG List

Google Me This

102 Seconds of Good

The BIG Wheel of Meat

Hospice Raffle

The BIG Morning Show talks about the foods they can’t live without and read your comments! ...Read more

The BIG Morning Show talks about the foods they can't live without and read your comments!

The BIG List of Birthdays & Anniversaries April 26, 2023 ...Read more

The BIG List of Birthdays & Anniversaries April 26, 2023

The BIG List of Birthdays & Anniversaries April 25, 2023 ...Read more

The BIG List of Birthdays & Anniversaries April 25, 2023

The BIG Morning Show’s ‘Name That Toot!’ is brought to you by Zip-N Car Wash ...Read more

The BIG Morning Show's 'Name That Toot!' is brought to you by Zip-N Car Wash

Hollywood Naps Remembering Names The BIG List Name That Toot Google Me This Itchy Eyes Price of Crab Meat ...Read more

Hollywood

Naps

Remembering Names

The BIG List

Name That Toot

Google Me This

Itchy Eyes

Price of Crab Meat